Why Tax Litigation Needs a Smarter Approach Today

High Volume of Notices & Appeals

Overwhelming inflow of legal documents and correspondence demands robust tracking and timely response.

Tight Statutory Deadlines

Strict timelines often lead to errors or missed submissions without a reliable alert and response system.

Delayed Stakeholder Responses

Critical delays in cross-functional approvals and expert responses can jeopardize legal compliance.

Fragmented Communication & Storage

Lack of centralized case communication and document storage leads to inefficiencies and legal risk.

High Dependency on Individuals

Compliance operations rely heavily on individual knowledge and memory, increasing risk during transitions.

One Platform. Total Control. Zero Surprises.

With rising Tax notices, tight deadlines, and constant stakeholder follow-ups, Compliance Cart helps you take back control.Compliance Cart is an innovative compliance management solution that is leading Digitization of Compliance Management. Our SaaS-based collaborative litigation management platform simplifies and automates the entire Tax litigation workflow — from receiving notices to final submission and recordkeeping.

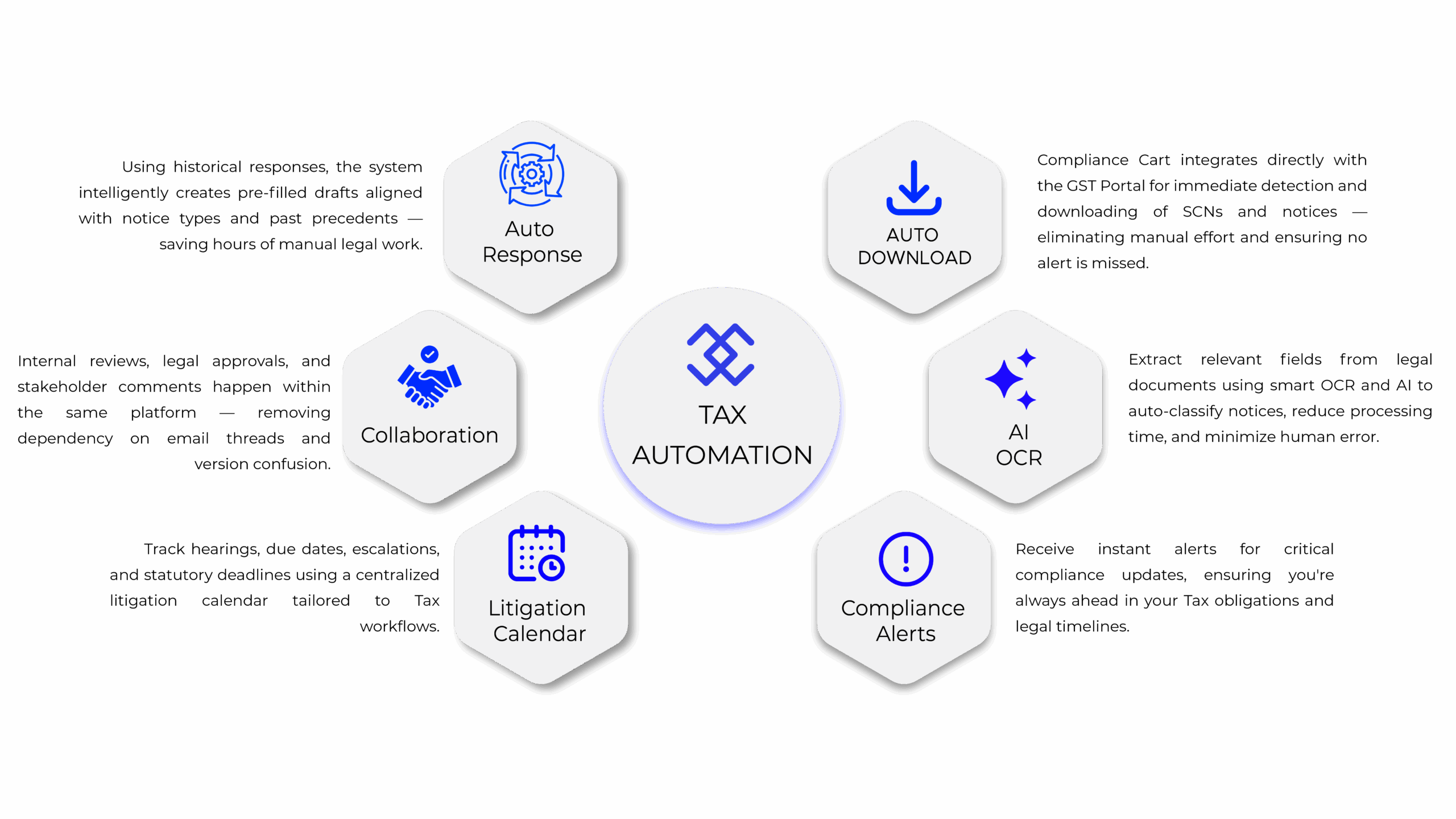

Automate Tax notice intake , AI-extract key fields, and track deadlines with confidence.

AI-assisted Tax litigation management with OCR-driven document processing

Speed up SCN responses, improve accuracy, and reduce penalty risks—all within Compliance Cart.

OCR for Document Extraction

Automatically extract data from SCNs, Tax orders, notices, and appeal filings—clean, structured, and ready to act on.

AI for Risk Analysis

Instantly highlight risky cases, missed deadlines, recurring issues, and bottlenecks across entities and jurisdictions.

Document Traceability

End-to-end trail from SCN to Appeal and High Court/Tribunal orders—evidence, versions, and actions in one place.

What’s coming next

Auto-Drafting Support

AI-suggested draft replies using your historical SCNs, past responses, and relevant regulatory rulings as context.

Regulatory Knowledge Base

Link extracted fields to Tax law references, case laws, and circulars—prepare robust responses faster.

Designed for Today’s Tax Landscape.

Response Preparation

Break down every Tax notice into clear, actionable tasks. Assign responsibilities, track progress, and meet deadlines – all from one smart dashboard.

Centralized Document Manager

No more scattered files or shared folder chaos. Store, organize, and access every document when you need it with zero data loss.

Stakeholder Collaboration

Unify your tax teams, consultants, and legal partners with secure, role-based access and in-platform communication.

SCNs & Appeal Workflows

Handle Show Cause Notices and Appeals with contextual continuity and shared evidence. Nothing falls through the cracks.

Litigation Calendar

Stay proactive and never miss a submission deadline. Auto-alerts keep every stakeholder in sync and informed.

Live Dashboards & MIS

Instant visibility into status, actionables, team performance, and trends across all your notices, appeals, and tasks.

Smart Automation that Saves You Time and effort.

Collaboration that Covers Everyone.

Internal and/or external stakeholders, from Tax, Finance, and Legal Teams to Tax Suvidha Providers, Tax Consultants, Logistics Partners, and Dealers. Compliance Cart ensures a secure and seamless collaboration across your ecosystem. .

What Sets Compliance Cart Apart?

Take Control of Your Tax Notices and Litigation Process

Experience how Compliance Cart can turn Tax chaos into timely and efficient litigation response.

BOOK A DEMO